OIL MARKET: Prices hover at $96.05 per barrel as traders take profit

By Our Correspondent

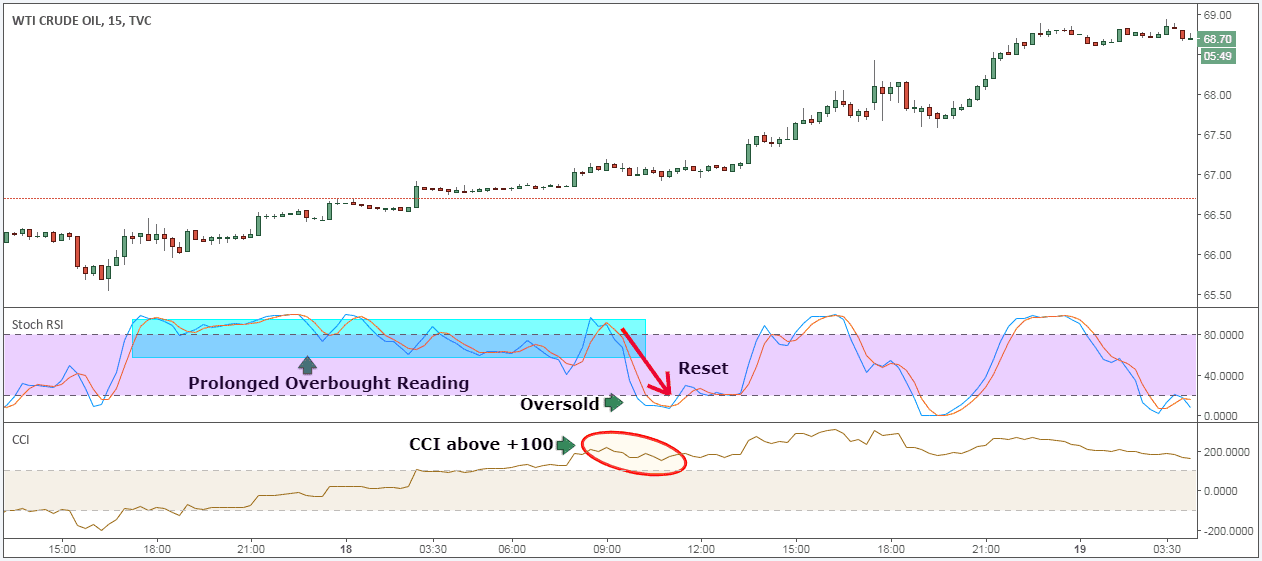

The prices of crude oil that had surged toward $100 per barrel has dropped slightly to $96 per barrel in the international market.

For instance, the price of Nigeria’s Bonny Light, which stood at $97.17 per barrel, on Wednesday, dropped to $96.05 per barrel while Brent also dropped to $92.36 per barrel.

But traders expect oil prices to bounce back in the coming weeks as market fundamentals remain strong.

Despite the quest for energy transition, the Organisation of Petroleum Exporting Countries, OPEC, had stated in its recent statement that, “It is an extremely risky and impractical narrative to dismiss fossil fuels or to suggest that they are at the beginning of their end. In past decades, there were often calls for peak supply, and in more recent ones, peak demand, but evidently neither has materialized. The difference today, and what makes such predictions so dangerous, is that they are often accompanied by calls to stop investing in new oil and gas projects.

“Such narratives only set the global energy system up to fail spectacularly. It would lead to energy chaos on a potentially unprecedented scale, with dire consequences for economies and billions of people across the world,” says OPEC Secretary General, HE Haitham Al Ghais.

This thinking on fossil fuels is ideologically driven, rather than fact-based. It also does not take into account the technological progress the industry continues to make on solutions to help reduce emissions. Neither does it acknowledge that fossil fuels continue to make up over 80% of the global energy mix, the same as 30 years ago, or that the energy security they provide is vital.

“Technological innovation is a key focus for OPEC, which is why Member Countries are investing heavily in hydrogen projects, carbon capture utilization and storage facilities, the circular carbon economy, and in renewables too. While some may suggest that a number of these oil-focused technologies are still immature, they ignore the fact that many technologies referenced in net-zero scenarios are at an immature, experimental or even theoretical stage.

“In recent years, we have seen energy issues climb back to the top of the agenda for populations as many glimpse how experimental net zero policies and targets impact their lives. They have legitimate concerns. How much will they cost in their current form? What benefits will they bring? Will they work as hyped? Are there other options to help reduce emissions? And what will happen if these forecasts, policies and targets do not materialize?

“Thankfully, there has been a reawakening across many societies of the need for energy security and economic development to go hand-in-hand with reducing emissions. In turn, this has led to a reevaluation by some policymakers on their approach to energy transition pathways.

“Cognizant of the challenge facing the world to eliminate energy poverty, meet rising energy demand, and ensure affordable energy while reducing emissions, OPEC does not dismiss any energy sources or technologies, and believes that all stakeholders should do the same and recognize short- and long-term energy realities,” says HE Al Ghais.

In the interests of contributing to future overall global energy stability, OPEC will continue to cooperate with all relevant stakeholders to foster dialogue, that includes the views of all peoples, so as to ensure inclusive and effective energy transitions moving forward.